CREDIT LIFECYCLE MANAGEMENT SOLUTION

by

Unicsoft

About

Our customer – YAPU Solutions – is a social FinTech company and startup from Berlin, Germany, offering consulting services for green inclusive finance. The company provides software for financial institutions in developing countries where there is an urgent need to ease access to finance for smallholder farmers, helping them increase working capital and streamline production.

These rather weak rural markets have a strong need to adapt to an increasing number of climate events by investing in nature-based solutions and thereby fostering their resiliency.

Ironically, people living in developing countries contribute the least to human-made climate change and, at the same time, are affected most by its adverse effects.

Challenge: MFI’s excessive operation expenses and ineffective farmers’ data collection and evaluation process

Our customer chose to help this industry from a FinTech perspective by digitizing the lending process for MFIs.

This approach would streamline the entire credit process for smallholder farmers from rural areas of Latin America and Africa and thus give them increased access to finance, and thereby the opportunity to invest in superior production techniques and climate resiliency.

Credit Lifecycle Management Solution

With this in mind, YAPU Solutions developed a product addressing two major problems:

1. The inefficient, non-digital processes of client data gathering and processing in many MFIs.

2. The high credit-risk for MFIs, due to a multitude of factors influencing the outcomes of agriculture and the lack of data on the productive reality of smallholders.

Agricultural business credit relies on various data: crop yield harvested in different months, farm’s location, number of employees, livestock population, agricultural machinery, etc. Once all data is gathered, a creditor must use a complex formula to manually calculate the potential risks and the farm’s business solvency. This is a lengthy process, and, on top of that, calculations often contain human errors that can push loan managers towards wrong decisions.

The YAPU Software, developed by Unicsoft, solves all these problems.

SOLUTION:

Flexible credit lifecycle management system with a comprehensive database

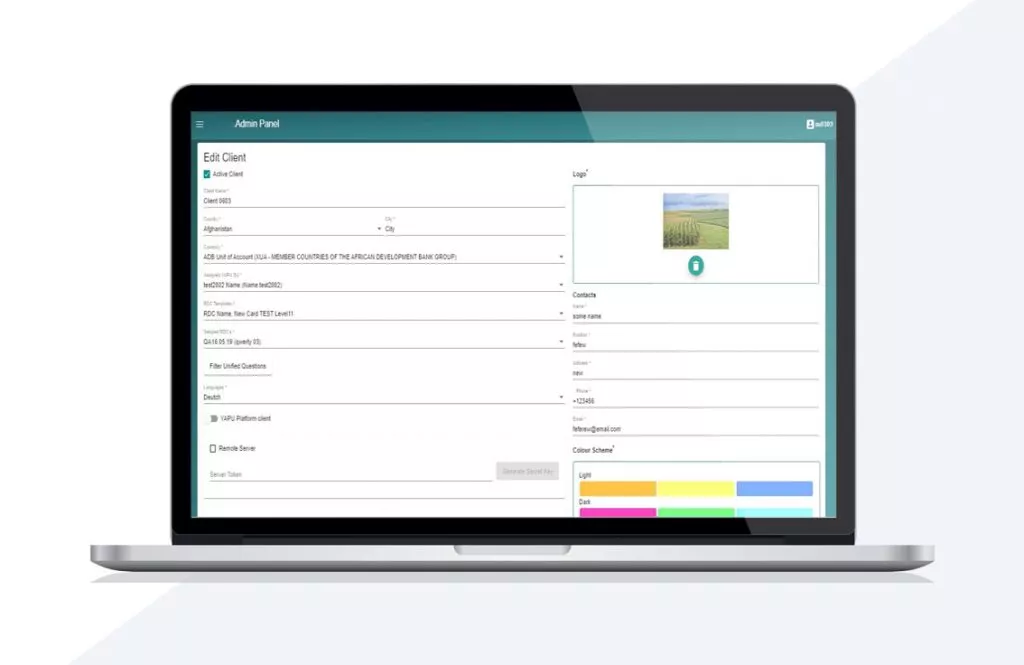

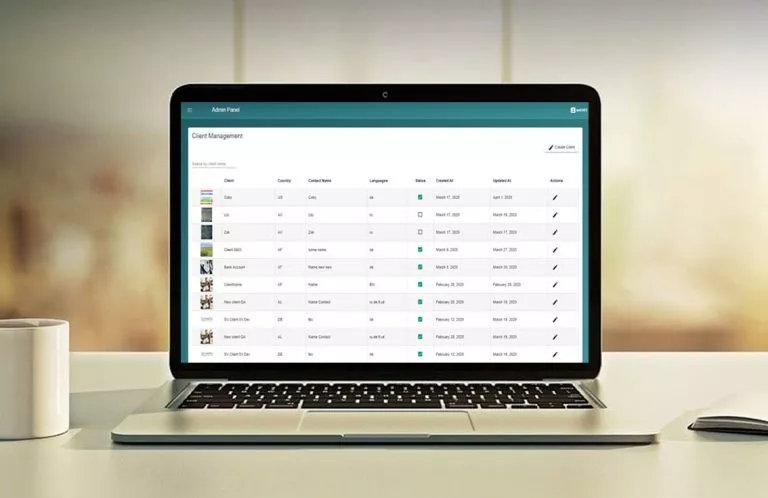

Unicsoft developed a comprehensive solution enabling MFIs to complete loan questionnaires and assess farmers’ statements on household members, income and costs activities, and farming practices digitally.

Credit Lifecycle Management Solution fintech

Based on the data collected, financial institutions can receive a full-fledged credit committee report instantly to predict possible risks and make objective, data-driven decisions.

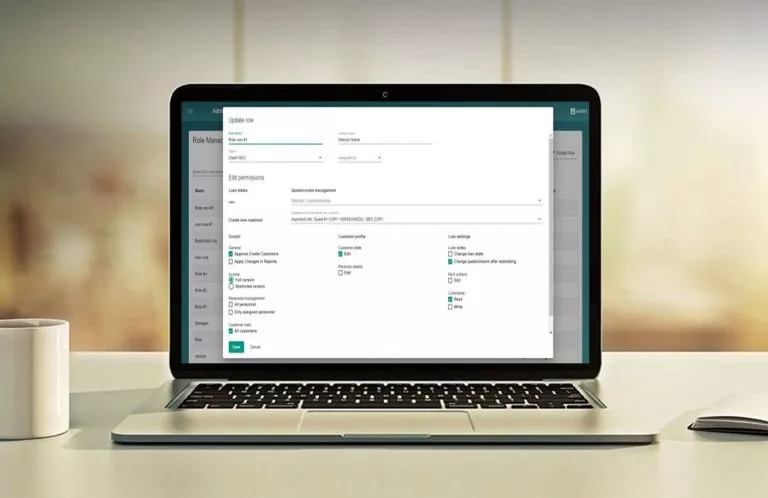

The system provides customizable loan questionnaires. Using the web version, bank managers can create various forms with needed data metrics and maps to indicate farm locations. Field managers use an Android mobile app to collect this data while in the field, then send it to their supervisors. The in-house management takes over to calculate the data and prepares it for consideration

The solution’s end users are:

regulated or non-regulated financial institutions, like MFis, cooperatives and banks

agricultural input providers

insurance companies

government initiatives for rural and agricultural financing and support

Development approach: effective project planning and enabling product scaling

Since we began our customer’s product development from scratch, the Unicsoft team adopted its tried-and-true software product development process to prevent typical challenges other startups face in the middle of MVP development.

Effective development resource planning. At the start of the project, Unicsoft completed a thorough project evaluation and planning in terms of effective resource allocation to prevent unnecessary spending and secure future updates. Based on our experience, we proposed to set up a core development team with full-stack developers, considering both web and mobile versions of the system. This approach helped us leverage the development process’s high flexibility, facilitate effective circular code review and ensure 100% efficient utilization of team resources.

Ensured fast product scaling. Initially, we launched MVP with skeleton features to attract investors’ attention. When the available MVP version began to hinder product scalability, we proposed the Unicsoft customer implement app refactoring to enhance system capacity. In a second iteration, Unicsoft developed a new MVP extended with advanced features, which accelerated product-market fit and was also a much faster version of the product ready for scaling and external integrations.

Established a communication process. We built an effective communication process to facilitate synergy between the business and tech team, and seamlessly run the project. When we met crucial milestones within the development process, the tech team needed more insights on business processes within financial institutions and our customer’s business strategy. To aid our teams, we leveraged onsite workshops in both Berlin and Kyiv to work on the system’s complex functional parts, make important decisions together and deliver more value.

Results: Real-time risks management & streamlined operations for MFIs

YAPU Software, currently used by more than 15 Institutions, delivers the following values for end-users and the market overall:

Saves financial managers time and effort – due to fully customizable questionnaires with hundreds of questions available, comprehensive reports covering numerous business metrics, complex calculations and integrations with maps.

Minimizes risks – users can conduct a 360° risk analysis which integrates production, market, climatic and environmental risks into the credit analysis.

Enhances productivity – with optimized processes and less risks, productivity gets a boost. Field processes that are remote and automated enable sound lending decisions.

Potential capacity: Strengthening the ecosystem between MFIs, climate solution providers, and smallholder farmer

The solution has great potential in becoming a crucial instrument to grow productivity in rural economies while building a resilient climate.

Next, we plan to take the following steps:

Integrate forecast services to predict weather conditions and crop yields, and as a result, take into account enhanced climate indicators within the credit assessment process. These services will foster the introduction of global, climate-smart financing.

Integrate the product with core banking systems so client data can be shared automatically and used for future credit processing automation.

aImplement data science and machine learning approaches to automate reporting and forecasting.

All in all, we are honored to continue working on this top-notch product. If you have a similar product in mind or simply an idea to create a breakthrough solution and need technical support, contact our experts today.